January 2022 - Week 4 Edition

Gold and Silver Poised for 2022 Gains

Gold and silver both shot into positive territory for the year, while some stock indexes officially fell into “correction” territory (10% below their peak levels). The tech-heavy NASDAQ is down 12% so far in 2022. At one point on Monday, January 24th, the Dow was down 10% from its peak (down 1,100 points for the day) and the S&P 500 was down 12%, but they rallied into positive territory by day’s end.

Gold ETFs Witnessed Their Biggest Single Daily Inflow Since Creation

Last Friday, January 21, the world’s largest gold-backed exchange-traded fund (ETF) saw its biggest daily buying surge since it was first listed almost 18 years ago, in 2004. The SPDR Gold Shares (GLD) reported inflows of $1.6 billion last Friday, its largest dollar volume of purchases on any single day since it was first listed. That’s equivalent to 27.6 metric tons of gold. This follows a year (2021) of the fund’s biggest annual outflows (195 metric tons, or about $14.1 billion) in almost a decade. This signifies that gold is back in favor in 2022 after a slightly negative year in 2021 and a strongly positive year in 2020. We know that a good percentage of new bullion customers become rare coin investors and collectors over the next two years. This, in turn, drives up the demand and prices of rare coins in the rare coin market.

On Monday, gold continued its price increases as it hit a two-month high, with silver outpacing gold on a percentage basis, up over 4%, also reaching its highest level in two months, mostly due to rising inflation figures and fears of higher commodity prices coming soon. The metals also rose over fears of a possible Russian invasion of Ukraine, as the State Department ordered diplomats and their families leave Ukraine.

Investors also await news from the first 2022 meeting of the Federal Reserve’s Open Market Committee this week, which usually results in pronouncements that move either gold or the stock market up or down.

The latest poll of traders shows that 91.6% expect the Federal Reserve to raise short-term interest rates at their next (March) meeting, up from 57.7% in the previous poll, taken a month ago. What’s more, there is growing concern that the Fed will raise rates by more than a quarter point, perhaps by half a point, since inflation is at its highest level in almost 40 years, and long-term rates have risen rapidly in the last month.

The Golden “49ers” Prevailed over the “Greenbacks” on “Gold Discovery Day”

The Green Bay Packers (representing Greenbacks) were favored by more points (6) than any other NFL playoff team last weekend, but the oddsmakers didn’t account for gold’s power on this Day in History….

It was on January 24, 1848, that James Marshall discovered GOLD on John Sutter’s mill at the junction of the American and Sacramento rivers in California. As it turned out, the two original gold discoverers, Sutter and Marshall, were unable to profit from that gold or defend their claim. Both died in poverty, but they changed the monetary history of America by luring thousands (eventually millions) of 49ers west.

In 1847, the year before the California gold strike, the total U.S. production of gold was only 43,000 ounces, mostly coming as a by-product of base metal mining, but 1848 yielded a 1,000% gain, to 484,000 ounces, and that total quadrupled again in 1849, to 1,935,000 ounces. Gold production peaked in 1853, at 3,144,000 ounces. This sudden influx of gold brought prosperity, but it also brought inflation.

Just like today, too much money created too fast brings inflation, and there was “too much gold” in the 1850s, but by the 1880s we had too little gold. Deflation ruled that decade – and well into the 1890s, when the nation was badly in need of more gold but none was to be found, resulting in the Panic of 1894.

On January 24, 1894, the U.S. Treasury’s gold reserve dipped dangerously below $100 million, the warning bell for the upcoming Panic of 1894. Wall Street investment banks underwrote a $50 million issue of gold bonds, selling them to the public and restocking gold in the Treasury back to $107 million. Later in 1894, another $50 million gold bond issue was underwritten by Drexel Morgan but on January 24, 1895, gold reserves hit a new low of $68 million, then $45 million the following week. (This gold shortage only ended with the discovery Klondike Gold!)

This Sunday, January 30th, the San Francisco 49ers play the Los Angeles Rams, where they are 3-to-4-point underdogs, but don’t count them out. The 49ers have won their last six matches with the Rams and gold has a storied history on January 30th. You might even say that gold has a score to settle on that date.

On January 30, 1934, Congress passed the Gold Reserve Act, giving President Franklin D. Roosevelt authority to set the price of gold – on his birthday, no less, so on January 31, FDR devalued the dollar by 41%, by raising the price of gold 69%, raising its official from $20.67 per Troy ounce to $35.00 per ounce. FDR also nationalized most gold supplies, including coins, bullion and gold certificates. For the next 41 years, it was a crime punishable by up to 10 years in prison to hold pieces of inert gold metal.

No wonder the 49ers beat the “Greenbacks” on that snowy frozen tundra of Lambeau Field on a blocked punt, despite scoring no offensive touchdowns, in a narrow 13-10 win last weekend – and no wonder the 49ers also won five of 13 consecutive Super Bowls on, or near, their historic January 24th Golden Date:

January 24, 1982: Super Bowl XVI (16) San Francisco 49ers 26, Cincinnati 21 in Pontiac, Michigan

January 20, 1985: Super Bowl XIX (19) San Francisco 49ers 39, Miami 16 at Stanford Stadium

January 22, 1989: Super Bowl XXIII (23) San Francisco 49ers 20, Cincinnati 16 in Miami, Florida

January 28, 1990: Super Bowl XXIV (24) San Francisco 49ers 55, Denver 10 in New Orleans

January 29, 1995: Super Bowl XXIX (29) San Francisco 49ers 49, Sam Diego 26 in Miami, Florida

Can they do it again? Gold also had red letter days on January 21, 1974, when it hit a record $161.31, and on January 21, 1980, when gold hit that record $850 price, a level it would not exceed until 2009.

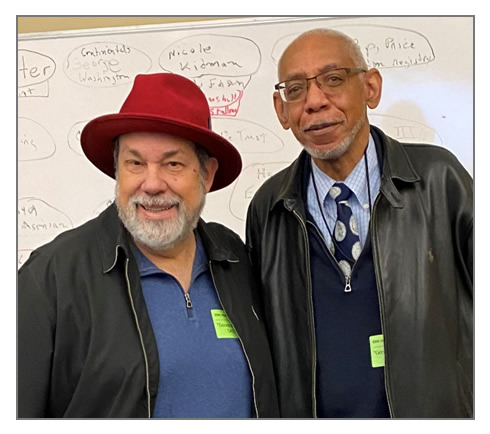

Dr. Mike Fuljenz Addresses Texas Coin Dealers

This past weekend, I was a featured speaker about gold coins at the big Money Show of the Southwest in Conroe, Texas. Convention officials were pleased with the increase in the number of dealers participating in the annual show. With gold and silver rising and more customers and dealers participating in the coin market, 2022 is looking like a very good year to buy gold and silver coins! I’d like to also mention that while there, I met with a long-time friend, Dr. Ralph Ross of Houston, current President of the American Numismatic Association.

Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher.