July 2018 - Week 2

U.S. Budget Deficits Begin to Soar Again – Putting Pressure on the Dollar

Gold rose above $1,265 Monday morning, July 9, before retreating to $1,260. Silver rallied from below $16 per ounce on Friday to reach $16.20 Monday morning before retreating. Gold rose even more in Britain, where there is added uncertainty over the resignation of two top officials – Foreign Minister Boris Johnson and Brexit Minister David Davis. It is now over two years since Britain voted (June 23, 2016) to exit the European Union (EU) and no real progress has been made in ironing out the details of Brexit.

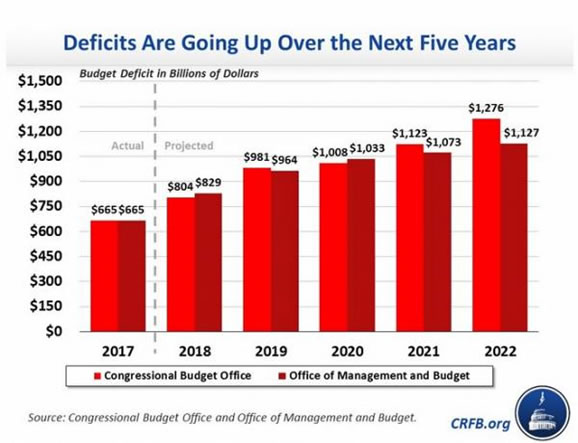

The big financial news in the second quarter was that the U.S. dollar rallied, sending gold down, but the dollar rally can’t be sustained with deficits sharply rising and long-term interest rates falling. Right now, the 10-year Treasury bond yields only 2.83%, down from over 3.10% in May, as massive new amounts of Treasury debt are not being bid up by the traditional international buyers like China and Japan, each of which owns well over $1 trillion in U.S. Treasuries and may not be willing to buy more in a “trade war.”

As of April 30, 2018, the cumulative U.S. National Debt surpassed $21 trillion, or nearly $65,000 for every man, woman and child in America. It took America over 200 years to accumulate its first trillion dollars in debt – from 1776 to 1981 – but we added another $20 trillion in just 37 years. There were three years of balanced budgets in 1999 through 2001 but spending on wars and recessions since then have ballooned the annual deficits to over $1 trillion per year in each of President Obama’s first-term years. The size of the annual deficits began decreasing in Obama’s second term and in Trump’s first year, but the combination of tax cuts and massive new spending bills this year pushed up the deficits once again.

Here’s the basic track record on deficits since the last balanced budget in FY-2001:

Deficits under eight years of George W. Bush = $3.3 trillion

Deficits under eight years of Barack Obama = $6.8 trillion

Fiscal 2017: $665 billion deficit in Donald Trump’s first year

Fiscal 2018: $803 to $829 billion deficit projected in Fiscal 2018, Trump’s second year

Total: $11.6 trillion in deficits in 18 years, or $644 billion average deficits per year

The federal fiscal year begins October 1 and ends September 30. According to the latest monthly report from the Congressional Budget Office (CBO), the Fiscal Year 2018 federal budget deficit was $530 billion for the first eight months of fiscal year 2018 (through May 31, 2018), $97 billion more than the same period in the previous year. Tax receipts were up by $55 billion (+2.54%), but spending was up by $152 billion (+5.84%), so the deficit rose by $97 billion (+22.4%), from $433 billion to $530 billion.

That projects to $795 billion for the full fiscal year, but the deficits are increasing, so the CBO projects a budget deficit of $803 billion this year. The Office of Management and Budget (OMB) projects $829 billion in red ink. This is not as bad as Obama’s first-term deficits, but they are definitely rising too fast.

Looking forward, deficits are expected to top $1 trillion per year again by 2020 and never drop below that level without drastic reduction in spending – meaning a reduction in “entitlements” like Medicare, Social Security, Obamacare, Food Stamps and other aid programs. We’ll see if America will “bite that bullet.”

The reason this is important to gold investors is that gold has done best when deficits were rising and the dollar was sinking – as in the 1970s and the 2000s. Gold rose the fastest from 1971 to 1980, when the dollar was weak and deficits were rising. That happened in a smaller way in the late 1980s, when the coin market took off strongly. Then we saw another decade of a falling dollar and rising deficits from 2001 to 2011, when gold rose from $255 to $1,900 and many Indian gold coins more than doubled in value from 2005-2008. When deficits began to decline in 2012, so did gold, but now that deficits are rising again, we could see the dollar resume its decline and gold and gold coins begin another bull market.

Call an account representative today to find out how select gold coins can help you better prepare for a rising deficit and declining dollar.

President Trump Fights Back Against China’s Massive Counterfeiting Empire

Last week, I wrote about Chinese counterfeiting in the coin market, but the story goes deeper than that.

The news tells the story of President Donald Trump raising tariffs on China, but that isn’t the whole story. He isn’t just concerned about our trade deficits with China. President Trump is even more concerned about China’s product piracy and counterfeiting. If you ever walk down a street in China as a tourist, you will find merchants selling “Disney” or “Apple” or “Coke” products that have no relation to the brand. These are fake products with a fake company label. Most Americans can see through this sham, but few see through the counterfeit products that the Chinese now ship overseas for sale via the Internet.

Craig Crosby, founder of The Counterfeit Report, has detected millions of knockoffs on eBay and Alibaba and 32,000 counterfeits on Amazon. Apple reported that 90% of all “Apple” products they purchased from Amazon were counterfeit. Counterfeiting is now the largest criminal enterprise in the world, netting $1.7 trillion per year, greater than illicit drugs or human trafficking. The volume is expected to grow to $2.8 trillion and cost 5.4 million jobs by 2022, and China produces 80% of these counterfeits. The Chinese also steal the technology of many U.S. companies doing business there, with impunity – until now. President Trump is the first U.S. leader to strongly strike back, and I hope he succeeds.

Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher.